Online Khata Transfer In Bangalore

Get Your Khata Transfer Online in Bangalore

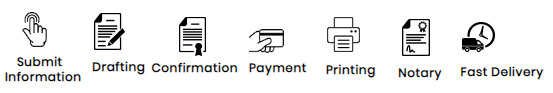

Procedure:-

What is A Khata?

It literally means an account that a person who has a property in Bangalore has. It is an account of the assessment of property owners within BBMP (Bruhat Bengaluru Mahanagara Palike) jurisdiction. Khata is important when you apply for any license of building or for trade, for applying for a loan from any bank or financial institution. It consists of all the details of the property like the name of the owner, size of the building, location of the property and all other details that helps to file property tax.

All property owners/holders who hold property within the BBMP jurisdiction are eligible to obtain a Khata. Obtaining a khata does not confer ownership of the property but confers liability to pay property tax. Property tax can be paid by property owners/holders who may or may not have a Khata. It is also needed to apply for electricity and water connections. It is necessary even while selling a property.

Procedure :-

Price :- NA

Contact Us

What is Khata Transfer?

Khata transfer is required when the ownership of property is transferred from one person to another for any reason like sale of property, gift, will or in case of death of property owner and so on. The application for Khata transfer is same as that for registration and the documents needed along with application are the following:

Documents required for Khata Transfer:-

- Absolute Sale Deed.

- Latest Tax paid receipt.

- Encumbrance Certificate.

- Previous Khata & Khata Extract copy.

- Customer has to pay fee of 2% on stamp duty what they paid at the time of Registration.

If any further Documents is required we will update you.

What is E-Khata?

E-Khata refers to electronic khata or computerized khata that can be filed by property owners. It enables property owners to pay their property tax online.

A property owner in Bangalore can avail E-khata only if the concerned property has been issued a valid khata as well as a PID (Property Identification) number. The khata and PID number is received by a property owner only after a thorough government verification of the property.

Any property that is listed under the B khata will not be able to avail E-Khata as B khata properties do not have PID numbers. Only those properties registered under the A khata and having a PID number assigned to them can obtain E-Khata.

Advantages of E-Khata.

There are several advantages associated with E-Khata, such as:

E-Khata allows property owners to make payments for their property tax online, at their own convenience and from the comfort of their home or office.

Property owners can receive property tax payment receipts using the PID number.

Property owners can easily obtain the latest khata certificate and extract for their property from any BBMP office.

Documents required for registration of E-Khata.

For a property owner having a property allotted by Bangalore Development Authority (BDA) or Karnataka Housing Board, the following documents are needed to apply for E-Khata registration along with the application form:

- Attested copy of the Absolute Sale Deed.

- Copy of the previous khata.

- Latest Encumbrance Certificate (EC).

- Copy of previous property tax receipt.

- Possession Certificate.

- Sketch showing the location and measurement of the property

- NOC from BDA for amalgamation or bifurcation.

- 3 Photos of the property owner.

- Copy of Photo ID proof of the property owner, such as PAN card/Passport/Driving License.