Mortgage Agreement In Bangalore

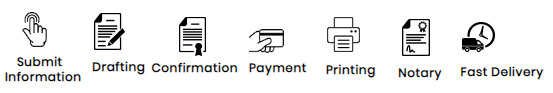

Procedure :-

Terms & Conditions :-

- Above mentioned price included Documentation, Printing, E-Stamp Paper of Rs.100/-, Handling & Courier charges.

- If customer wants E-Stamp Paper value more than Rs.100/- price will be difference.

- If customer have his own draft & if it exceeds more than 2 pages, after 2 pages it will be chargeable of Rs.25/- per page.

- Estimated Delivery Timings:- 24 Hours

Please fill in the below details

- Owner Details

- Tenant Details

- Clauses of Agreement

- Customer Details

- Submit Your Details

Step 1 - Fill in Owner Details

Owner Name:

Owner Age:

S/o, D/o, W/o :

Owner Address :

Step 2 - Fill In Tenant Details

Tenant Name:

Tenant Age:

S/o, D/o, W/o :

Tenant Address :

If More Than One Tenants fill this : (Name & Age)

Step 3 - Fill In Clauses of Agreement

Mortgage Premises Address:

Mortgage Commencement Date :

Mortgage Security Amount :

Payment Mode of Security Amount : (Cash / Cheque / Bank Transfer)

Mortgage Period :

Notary (Note :- Notarized Rental Agreement hold strong legal proof)

Any additional points added to the agreement : (Eg, Terms & Conditions)

Step 4 - Fill in Customer & Shipping Details

Customer Name:

Customer Mobile Number :

Customer Email ID:

Shipping Address :

Step 5 :- Confirm your details & receive a draft

Some required Fields are empty

Please check the highlighted fields.

Please check the highlighted fields.

Mortgage Agreement Description & Requirements :-

~A Mortgage Agreement is a pledge by a borrower that they will relinquish their claim to the property if they cannot pay their loan.

~Contrary to common belief, a Mortgage Agreement isn’t the loan itself, it’s a lien on the property.

~Property can be expensive and sometimes a lender wants more than just the loan agreement to back everything up.

~A Mortgage Agreement is the remedy in case the loan isn’t repaid.